Applying for a personal loan with Siam Digital Lending (SiamDL) has become increasingly popular in the digital age. With a streamlined, fast, and transparent process, coupled with the convenience of applying online via a mobile application, SiamDL offers a modern lending solution. However, prospective borrowers often wonder what steps are involved in the approval process and how to maximize their chances of getting approved.

This comprehensive guide will outline all the key steps, the benefits of using SiamDL, and why borrowing through a regulated legal lending system is the safest and most appropriate option.

-

Preparing Documents for Loan Application

Before starting your personal loan application with SiamDL, gather the following essential documents:

- National ID Card: For identity verification.

- Salary Slip or Proof of Income: Demonstrates your ability to repay the loan.

- Bank Account Information: For fund transfer post-approval.

Having these documents ready, complete, and clear will help reduce processing time and increase the likelihood of a quick approval.

-

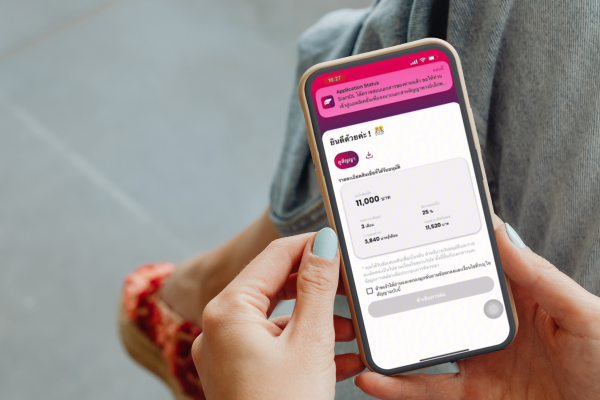

Filling Out the Application on the SiamDL App

SiamDL offers a user-friendly application system that simplifies the personal loan application process. Follow these steps:

Step 1: Download and Register

- Download the SiamDL app from Google Play or the App Store.

- Register using your mobile number and verify it with an OTP (One-Time Password).

Step 2: Complete the Online Application

- Enter your personal details, such as name, address, and occupation.

- Provide information about your income and expenses.

Step 3: Identity Verification via NDID

- Use the NDID (National Digital ID) system to securely and conveniently verify your identity.

Step 4: Upload Required Documents

- Upload the necessary documents, including:

- A recent bank statement (latest 1 month).

- A recent salary slip.

Step 5: Await Approval

- Check the app for your approval status, typically within 15 minutes.

This entirely digital process makes applying for emergency loans or online loans simple, safe, and efficient.

-

Automated Data Verification with AI Systems

Once your information and documents are submitted, SiamDL’s AI system begins the verification process, which is central to loan approval.

- Information Accuracy Check: Validates personal details and supporting documents.

- Debt Repayment Capacity Analysis: Assesses your ability to repay the loan based on income and expenses.

- Credit Bureau Check: Reviews your financial history and creditworthiness through a national credit database.

This advanced system ensures quick and accurate processing, allowing applicants to receive approval within just 15 minutes.

-

SiamDL Loan Approval Criteria

Borrower Qualifications

- Age: 20-60 years.

- Regular income source.

- No history of unpaid debts.

Approved Loan Amount

Loan amounts are determined by your income and repayment capacity. SiamDL prioritizes responsible lending to prevent over-indebtedness.

Interest Rates

- Transparent interest rates with no hidden fees.

- Loans are compliant with regulations for legal lending, ensuring borrower safety.

-

Key Benefits of SiamDL Personal Loans

- Speed and Convenience:

- Applications and approvals take only 15 minutes, making it ideal for those needing quick cash or online emergency funds.

- Safety and Legality:

- SiamDL operates under strict regulation by financial authorities, ensuring compliance with legal standards.

- Advanced Technology:

- The use of AI accelerates and enhances accuracy in application processing.

- Transparency and Trustworthiness:

- No hidden charges, and all terms can be reviewed directly via the app.

-

Tips to Increase Your Approval Chances

- Maintain Good Credit History: Timely repayment of debts boosts your creditworthiness.

- Provide Accurate Information: Ensure all details and documents are correct to avoid delays.

- Request Reasonable Loan Amounts: Applying for an amount in line with your income increases approval likelihood.

Conclusion

Applying for a personal loan with Siam Digital Lending is the ideal choice for those seeking convenience, speed, and security. Leveraging AI technology ensures efficient processing, meeting financial needs within just 15 minutes.

If you’re searching for a reliable source of funds and need online emergency cash or a legal loan, SiamDL is your best option.

Siam Digital Lending: Your Trusted Financial Partner for Every Need

Download the App and Start Today!

Ready to apply for a personal loan with Siam Digital Lending? Download the app now from Google Play or the App Store to experience the ease and convenience of the process.

Contact Us

For inquiries or assistance, reach out to us:

- Address: 8th Floor, Dr. Gerhard Link Building, Soi Krungthep Kritha 7, Hua Mak, Bang Kapi, Bangkok 10240.

- Phone: 02 016 9300 (Office Hours: 08:30 – 17:30).

- Email: [email protected].

Follow Us Online

- Line: @siamdlloan

- Facebook: Siamdl Finance

- Instagram: siamdlloan

- YouTube: siamdlloan

- TikTok: siamdlloan

#SiamDL #SiamDigitalLending #PersonalLoan #FastApproval