In today’s digital age, applying for personal loan has become increasingly simple and convenient. Consumers have a variety of options, ranging from banks and traditional financial institutions to modern app-based services like Siam Digital Lending (SiamDL). SiamDL specializes in offering quick cash loans and online loan services, making it an appealing choice for users seeking fast and efficient solutions.

This article will highlight the key differences between SiamDL’s services and those of other financial institutions. It will also explore why SiamDL is an excellent choice for those in need of instant online loans or personal financing.

-

Application Process

Siam Digital Lending:

- Online Process: You can apply for a loan entirely through the SiamDL app.

- Steps: Register by scanning your national ID card, filling out personal details, verifying identity via NDID (National Digital ID), and uploading essential documents like bank statements and salary slips.

- Speed: Approval takes no longer than 15 minutes.

Other Financial Institutions:

- Offline and Online Options: Applications often require visiting a branch or filling out extensive online forms.

- Processing Time: Verification and approval can take several days or even weeks.

Conclusion: SiamDL stands out for its speed and simplicity, ideal for those seeking urgent cash loans.

-

Eligibility Criteria

Siam Digital Lending:

- Accessible Requirements: Applicants must be aged between 20–60 years, have a minimum monthly income of 12,000 THB, and provide proof of income.

- Inclusivity: Designed for middle-to-low-income earners.

Other Financial Institutions:

- Stricter Requirements: Often require a minimum income of 15,000 THB and a minimum employment tenure of six months in the current position.

Conclusion: SiamDL is better suited for individuals with lower income levels or those who require more flexible eligibility criteria.

-

Loan Limits and Interest Rates

Siam Digital Lending:

- Customizable Loan Limits: Loan amounts are tailored to the borrower’s income.

- Transparent Interest Rates: Interest calculations are straightforward, allowing borrowers to estimate repayment plans easily.

Other Financial Institutions:

- Higher Loan Limits: May offer higher maximum loan amounts in some cases.

- Hidden Costs: Interest rates may be slightly lower, but additional fees can be buried in fine print.

Conclusion: SiamDL offers clarity in interest rates and user-friendly terms, ensuring transparency and affordability.

-

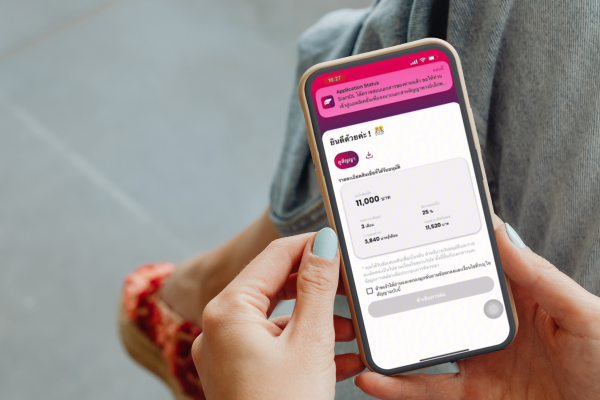

Convenience and Accessibility

Siam Digital Lending:

- Fully Digital: All processes—from application to approval tracking—are handled via the app.

- No Travel Required: Eliminates the need to visit branches.

Other Financial Institutions:

- Hybrid Approach: Some steps may require branch visits, and physical documentation is often necessary.

Conclusion: SiamDL caters to the digital-savvy consumer seeking convenience in the modern age.

-

Security and Credibility

Siam Digital Lending:

- Regulated by the Bank of Thailand: Ensures compliance with legal and financial standards.

- Legal Loans Only: All services adhere to laws and regulations, providing users with peace of mind.

Other Financial Institutions:

- Established Standards: Most traditional institutions have robust security measures, though their systems can be more complex.

Conclusion: SiamDL matches the trustworthiness of major financial institutions, making it a reliable option for borrowers.

-

Suitability for Different Borrower Types

Siam Digital Lending:

- Fast and Simple: Ideal for those seeking quick, straightforward personal loans without high income requirements.

- Emergency Funding: Perfect for addressing urgent financial needs.

Other Financial Institutions:

- Specialized Needs: Suitable for borrowers needing higher loan amounts or extended repayment terms.

Conclusion: SiamDL provides flexible services that cater to a broad range of customer needs.

-

Frequently Asked Questions About Personal Loans

Why Choose Personal Loans with SiamDL?

- Speed: Approvals within 15 minutes.

- Transparency: Clear interest rates with no hidden charges.

- Convenience: Fully digital application process accessible anytime, anywhere.

Are SiamDL’s Personal Loans Secure?

- Absolutely: SiamDL is legally compliant and supervised by the Bank of Thailand, ensuring the safety of your financial data.

What is the Maximum Loan Amount?

- Loan limits depend on the borrower’s income, with a maximum amount subject to SiamDL’s policies.

Conclusion

Choosing the right personal loan provider is crucial. SiamDL shines in terms of speed, convenience, and transparency, making it the perfect choice for those needing urgent or online loans without cumbersome processes.

While traditional financial institutions may be more suitable for those seeking higher loan amounts or specific conditions, SiamDL’s simplicity and efficiency in the digital age make it an excellent alternative.

Download the App and Start Today!

Ready to apply for a legal personal loan with Siam Digital Lending? Download the app now from Google Play or the App Store to experience the ease and convenience of every step in the personal loan process with SiamDL.

Download Now:

- Android: Download Here

- Apple: Download Here

Maximize Your Needs with SiamDL’s Versatile, Collateral-Free Personal Loans

- No Collateral or Guarantor Required: Borrow up to five times your average monthly income, capped at 200,000 THB, with repayment terms of up to 30 months.

- Quick Approvals: Know your loan status in as little as 15 minutes.

- Fully Online: From application to disbursement, track and manage your loan seamlessly online.

- Legal and Transparent: Loans are regulated by the Bank of Thailand and compliant with the Personal Data Protection Act (PDPA).

- Inclusive Eligibility: Available for individuals with a minimum income of 12,000 THB.

Contact Us

At Siam Digital Lending Co., Ltd., we provide financial products tailored to customer needs while promoting access to legal loans. This aligns with the Bank of Thailand’s mission to reduce reliance on informal lenders and alleviate household debt.

- Address: 8th Floor, Dr. Gerhard Link Building, Soi Krungthep Kritha 7, Hua Mak, Bang Kapi, Bangkok 10240.

- Phone: +66 2 016 9300

- Hours: Mon–Fri, 8:30 AM–5:30 PM

- Email: [email protected]

Find Us Online

- Line: @siamdlloan

- Facebook: SiamDL Finance

- Instagram: @siamdlloan

- YouTube: SiamDL Loan

- TikTok: @siamdlloan

#SiamDL #SiamDigitalLending #PersonalLoans #OnlineLoans #LegalLoans