In today’s world, where expenses are constantly rising, managing finances to meet all your needs can be a challenge. Effective financial management is crucial for achieving life goals, whether it’s building an emergency fund, reducing debt, or securing a stable future.

While sound financial planning is key, leveraging financial tools like personal loans or Legal Loan Apps offered by various providers in the market can be a lifesaver during urgent financial needs. However, before opting for a loan, it’s essential to first understand and practice disciplined income and expense management.

Apply Today for 100% online legal loans via our app!

Why Financial Management Matters: Techniques for Recording Income and Expenses and Helpful Legal Loan Apps

The Importance of Financial Management

Financial management is a crucial skill for building stability and reducing life’s uncertainties. A well-thought-out spending plan helps avoid debt, ensures emergency funds are available, and provides clarity about your financial status. This enables better future planning, such as saving for a house or investing to grow wealth. Below are some key reasons why effective financial management is essential:

1. People Are Living Longer

Thanks to advancements in medical technology, life expectancy has increased. This means we need to save more for retirement. Previously, the average lifespan was around 70 years, giving a retiree just 10 years to plan for post-retirement expenses (assuming retirement at 60). Now, with an average life expectancy of 76 years, individuals must prepare for at least 15 years of retirement, even though their working years remain the same.

2. Demographic Changes: Aging Population and Declining Birth Rates

The Baby Boomer generation, which experienced the highest birth rates, is now nearing retirement. As a result, the working population is shrinking, and most of the country’s population will soon consist of elderly individuals. This demographic shift puts additional strain on government welfare systems, which may become insufficient. Planning finances to rely less on government support has become critical.

For those with children, financial help from the next generation may be possible. However, if you’re single or childless, saving for retirement is essential to maintain independence and access necessary services with ease.

3. Rising Inflation and Lower Interest Rates

Did you know that decades ago, Thailand’s bank deposit interest rates were as high as 15%? Back then, people could live off the interest alone. Now, interest rates have dropped significantly to just 0.5–1%, excluding special deposit schemes. At the same time, inflation rates hover around 2.5–3%. This means that without proactive financial strategies, simply saving money in a bank could erode your wealth over time.

By understanding these challenges, you can take proactive steps to secure your financial future. Consider using tools such as legal loan applications, which can provide a reliable safety net during emergencies.

4. Life’s Uncertainties

Unexpected events can happen at any time, such as accidents, illnesses, or natural disasters like storms, fires, or floods. Some incidents might be minor inconveniences, but others can be significant obstacles that are difficult to manage. That’s why having an emergency fund and implementing risk management strategies are crucial to navigating such challenges effectively.

5. To Become Debt-Free

For many, living without debt is a significant achievement. People often carry multiple types of debt, such as car loans, mortgages, and credit card balances. Being free of debt not only brings peace of mind but also enables saving and building wealth. Transitioning from a debt-ridden status to having substantial savings is no easy feat—it requires solid financial planning and discipline.

Who Needs Financial Planning?

Financial planning is essential at every stage of life. Regardless of age or occupation, everyone should save and manage their finances wisely to suit their personal and professional circumstances. Here’s a breakdown by life stage:

Childhood

Parents should instill good financial habits in their children early on. Teaching them to save and manage their allowances responsibly helps develop lifelong financial discipline, laying a strong foundation for adulthood.

Working Age

This stage is about building wealth and achieving independence. Without a proper financial plan, money may be wasted on social trends like eating out, traveling, or shopping. Poor planning can delay significant milestones like buying a car, purchasing a home, getting married, or starting a family.

Family-Building Stage

Managing a household involves more than personal expenses—it includes caring for other family members. A well-structured financial plan is vital to cover monthly necessities, such as food, housing, and transportation, as well as children’s education, unexpected repairs, medical bills, and family vacations.

Retirement

While financial burdens may decrease during retirement, careful planning is still necessary to avoid becoming a burden on younger generations. As income usually diminishes in this phase, healthcare expenses often increase. Proper preparation ensures retirees can maintain a comfortable lifestyle.

Start your financial journey today with SiamDL Personal Loan, a legal and convenient solution available through our mobile app. Apply 100% online now!

Recommended! The Key to Financial Stability: Essential Financial Management Tips

At different stages in life, many people dream of living a well-rounded and fulfilling life, particularly in terms of career and finances, to lay the foundation for future security. With the current financial challenges, it’s more important than ever to stay prepared for managing finances. Let’s explore essential financial management techniques to build wealth and achieve financial stability.

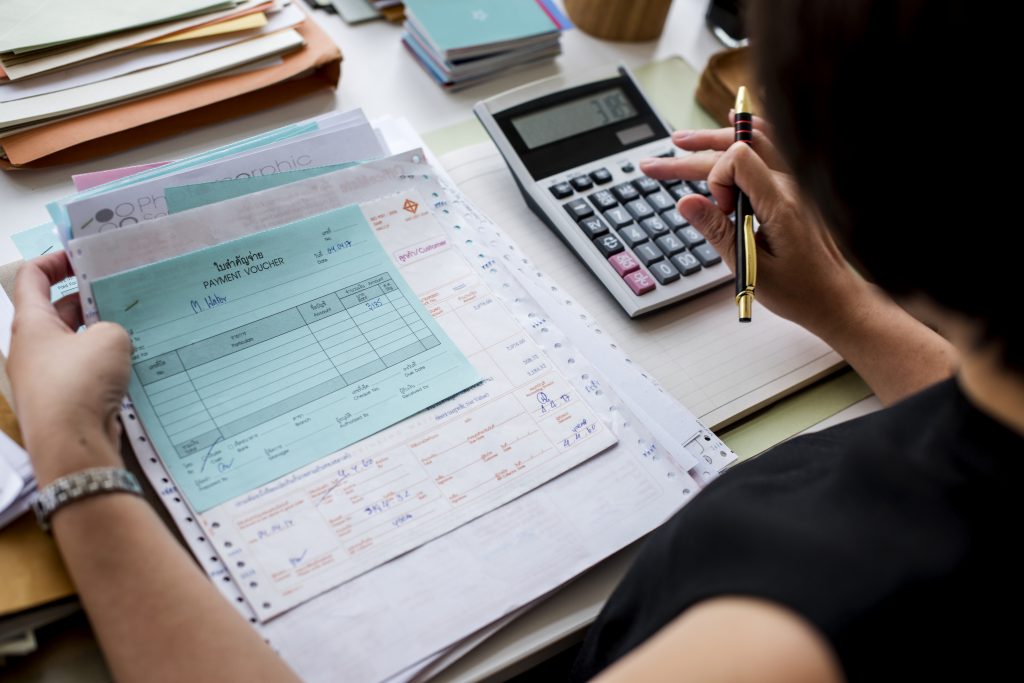

1. Record Your Income and Expenses Daily

Recording your income and expenses will help you understand your spending behavior. It shows where most of your money goes, such as food, transportation, or shopping. It also enables you to plan your monthly budget efficiently and gives you a clear idea of whether you’re overspending.

How to Record Your Income and Expenses Effectively

- Choose a method that suits you: Whether using paper or an online app, choose a recording method that fits your lifestyle and makes you more likely to stick to it.

- Categorize your spending: Group your expenses into categories like fixed costs (e.g., rent, utilities), variable costs (e.g., food, transportation), non-essential expenses (e.g., shopping, entertainment), and savings and investments for long-term goals.

- Tips for effective recording: Start small and don’t worry if you miss entries initially. Focus on tracking significant expenses first, then set goals like reducing unnecessary spending by 10% next month. Review your records monthly to see if you’re sticking to your goals.

2. Divide Your Money Using the 50/30/20 Rule

This popular method is simple and practical for effective money management.

- 50% for necessities: Covers basic living expenses, such as rent, utilities, and food.

- 30% for personal spending: Used for discretionary expenses, such as shopping or activities that bring you joy.

- 20% for savings and investments: This portion should be allocated to long-term goals, like saving for a home or investing in mutual funds.

Tip: If you have an unpredictable income, such as being a freelancer, you can adjust the ratio to 60/20/20 for added financial security.

3. Set Clear Financial Goals

Having financial goals gives you the motivation to manage your income and expenses with discipline.

- Short-term goals: For example, saving for a new smartphone within six months.

- Long-term goals: For example, saving for retirement or buying a house in the next 10 years.

How to Track Progress:

Use charts or apps that display savings progress in graph format to see if you’re on track with your goals.

4. Use Credit Wisely to Strengthen Financial Stability

Sometimes, accessing additional funds may be necessary, such as expanding a business or addressing an emergency. What’s crucial is to choose a Legal Loan Apps that is safe and reliable. Here are things to consider before applying for an online loan:

- Check if the app or provider is certified by relevant authorities like the Bank of Thailand.

- Read the details on interest rates and payment terms thoroughly.

- Compare offers from multiple providers to choose the best option.

Siam Digital Lending: A Trusted Legal Loan Apps

The Siam Digital Lending app is another great option for those looking for a Legal Loan Apps. You don’t need to provide collateral or a guarantor. The app offers a loan amount of up to 5 times your average monthly income, with a maximum limit of 200,000 THB. You can also choose to repay over a period of up to 30 months.

Loan Approval

- Quick loan approval: Find out if you’re approved within 15 minutes.

- Fully online personal loan services: Apply, receive money, check balances, pay bills, and view your payment schedule online.

- Legal loan services: Regulated by the Bank of Thailand, ensuring the security of your data in compliance with the Personal Data Protection Act (PDPA).

- Transparent and fair service: With an interest rate of 25%, Siam Digital Lending provides ethical loans and offers advice on managing debt.

- Low-income applicants welcome: Minimum income starting from 12,000 THB.

- Fulfill your needs: Apply for an unsecured personal loan from SiamDL.

The app is now available for download on Google Play or the App Store. Experience the ease and convenience of applying for a personal loan with Siam Digital Lending. (Borrow responsibly and repay within your means.)

Effective financial management starts with tracking your income and expenses and using the right tools, such as budgeting apps or secure online loan applications. Siam Digital Lending is here to be your trusted partner in building financial stability.

Apply for SiamDL Personal Loan on Android

Apply for SiamDL Personal Loan on iOS

Call Us!

Explore more interesting articles!

- Pay Water & Electricity Bills – Get Cash Loans Legally

- 7 Digital Savings Accounts with High Interest Rates in 2024

- 6 Tips for Easy Loan Application Success

- Why Fuel Prices in Thailand Aren’t Dropping According to Global Market Trends

- What Online Sellers Need to Know About Taxes

- List of Banks and Financial Institutions Cutting Loan Interest Rates by 0.25% for 6 Months

Please become SDL Fan

- Facebook: Siam Digital Lending

- Website: https://siamdl.co.th

- Line: @siamdlloan

- Tel: 02 016 9300

- Youtube: https://lnkd.in/gbQf9eh

- LinkedIn: https://www.linkedin.com/company/siamdigitallending/

- Instagram: https://instagram.com/siam_dl?igshid=YmMyMTA2M2Y=

#SiamDL #SiamDigitalLending #PersonalLoan #QuickLoans #LegalLoanApp

#LoanApp #LowInterestRates #QuickApproval #LoanApp #RepaymentMethods #SiamDL

#Finance #OnlineLoans